FREE PERSONAL PROMISSORY NOTE TEMPLATE

A personal promissory note template serves as a written record of a personal loan or debt agreement between individuals and is often used in situations where money is being borrowed or lent between friends, family members, or acquaintances.

It is a legally binding document in which one person, referred to as the "maker" or "promisor," promises to pay a specific amount of money to another person or entity, referred to as the "payee" or "holder," on a specified date or upon demand.

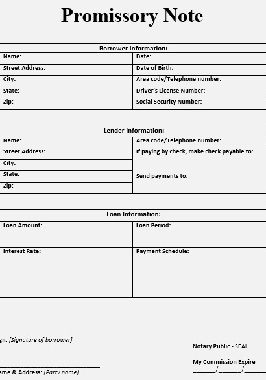

7 things you should include when writing a Personal Promissory Note Template:

- The names and addresses of both the borrower (promisor) and the lender (payee).

- The date when the promissory note is created.

- Both the borrower and the lender should sign the promissory note to indicate their agreement and acceptance of the terms.

- The specific amount of money being borrowed.

- Include the schedule for repaying the loan, including the due date or dates and the method of payment.If interest is charged on the loan, clearly state the interest rate and how it will be calculated.

- Outline what will happen if the borrower fails to repay the loan as agreed, such as additional fees, penalties, or legal action.

It is a good idea to consult with an attorney to make sure that the promissory note complies with the laws and regulations applicable in your State of residence. This will provide greater protection in case of any disputes and help to make the document legally enforceable. in your jurisdiction.

Reasons why you should write a Personal Promissory Note template:

- A written promissory note establishes a legally enforceable contract. If the borrower fails to repay the loan as agreed, the lender can use the promissory note as evidence to pursue legal action, if necessary.

- It provides clarity regarding the terms of the loan, such as the loan amount, repayment schedule, interest rate (if applicable), and any other relevant terms and conditions. Having everything in writing helps avoid misunderstandings or disputes in the future.

- When dealing with loans between friends or family members, having a formal promissory note can help maintain a sense of professionalism and trust by clearly outlining the terms of the loan.

- It serves as proof that a debt exists and that there is an obligation to repay it. This can be useful for both the lender and the borrower to keep track of financial transactions and records.

- Writing a promissory note can encourage both parties to take the loan agreement seriously and be more accountable for their financial commitments.

PERSONAL PROMISSORY NOTE TEMPLATE

(Your Name)

(Your Address)

(City, State, Zip Code)

(Date)

I, _______________________ (Borrower's Full Name), residing at ___________________ (Borrower's Address), hereinafter referred to as the "Borrower," promise to pay to __________________________ (Lender's Full Name), residing at ____________________ (Lender's Address), hereinafter referred to as the "Lender," the sum of _____________________ (Loan Amount in words e.g., "Two Thousand Dollars") ____________ ($2,000.00), with interest at the rate of ______ (Interest Rate)% per annum.

Method of Payment: All payments shall be made in ____________________ (payment method, e.g., cash, check, bank transfer, etc.) to the Lender's designated account as follows: __________________________________________ (Bank Account # and other relevant payment details).

Repayment Terms: The Borrower shall repay the loan in _____(number of installments, if applicable) equal installments, with the first payment due on ___/___/_____ (First Payment Due Date) and subsequent payments due on the same day of each month until the loan is fully repaid.

Prepayment: The Borrower may prepay the outstanding loan amount, in whole or in part, at any time without penalty.

Default: In the event of a default, where the Borrower fails to make any payment due within ___ (number of days) days from the due date, the Borrower shall be considered in breach of this agreement. The Lender shall have the right to demand immediate payment of the entire outstanding loan amount, including accrued interest, and may pursue legal remedies to recover the debt.

Entire Agreement: This Promissory Note constitutes the entire agreement between the Borrower and the Lender and supersedes any prior oral or written agreements or understandings.

Governing Law: This Promissory Note shall be governed by and construed in accordance with the laws of ____________________ (State/Country), without regard to its conflicts of law principles.

IN WITNESS WHEREOF, the Borrower has executed this Personal Promissory Note as of the date first above written.

______________________________

(Borrower's Signature)

______________________________

(Lender's Signature)

In order to ensure the document's legality and accuracy, consider having it reviewed by a legal professional in your jurisdiction.

This is just a sample, and it's essential to adapt the terms and language to suit your specific situation.

INTEREST RATES(Usury Laws) - the maximum rate of interest a lender can charge in each State

Alabama - 8% for written contracts, 6% for verbal agreements. Ala. Code § 8-8-1

Alaska For loans less than $25,000, 5% above the 12th Federal Reserve District interest rate on the day the loan was made, or 10%, whichever is greater. If the amount is more than $25,000, there is no maximum rate. Alaska Stat. § 45.45.010

Arizona No limit for loan agreements in writing. If not in writing, the rate shall be 10% per annum. Ariz. Rev. Stat. Ann. § 44-1201

Arkansas Rate of interest may not exceed the maximum of 17% as established in the Arkansas Constitution, Amendment 89. Ark. Code Ann. § 4-57-104

California Rate may not exceed 10% per year on loans for personal, family, or household purposes. For other loans for other purposes, the maximum is the higher of 10% or 5% over the amount charged by Fed. Res. Bank of San Francisco at the time loan was made. Cal. Const. Article XV, § 1

Colorado For supervised loans general usury limit is 45%, and the maximum for unsupervised loans is 12%. Colo. Rev. Stat § 5-12-103 and § 5-2-201

Connecticut The interest rate may not exceed 12%. Conn. Gen. Stat. § 37-4

Delaware Not in excess of 5% over the Federal Reserve discount rate at the time the loan was made. Del. Code. Ann. tit. 6, § 2301

Florida General usury limit is 18%, 25% on loans over $500,000. Fla. Stat. § 687.03 and § 687.01

Georgia The default is 7% if no written contract is established. For written contracts, the maximum 16% on loans below $3,000, 5% per month on loans between $3,000 and $250,000, and no limit on loans above $250,000. Ga. Code Ann. § 7-4-2 and § 7-4-18

Hawaii The default is 10% if no written contract is established, 12% is the general usury limit, and 10% is the limit on judgments. Haw. Rev. Stat § 478-2, § 478-3, and § 478-4

Idaho Unless stipulated in a written agreement, the legal rate is 12%. The rate of interest on money due on court judgments is 5%. Idaho Code Ann. § 28-22-104 IllinoisThe general usury limit is 9%. 815 Ill. Comp. Stat 205/4

Indiana 8% in the absence of agreement, 25% for consumer loans other than supervised loans. Ind. Code § 24-4.6-1-102 and § 24-4.5-3-201

Iowa The maximum interest rate is 5% unless otherwise agreed upon in writing, in which case, maximum is set by Iowa Superintendent of Banking (IA Usury Rates). Iowa Code § 535.2(3)(a)

Kansas The legal rate of interest is 10%; the general usury limit is 15%. Kan. Stat. Ann. § 16-201 and §16-207

Kentucky The legal rate of interest is 8%, the general usury limit is 4% greater than the Federal Reserve rate or 19%, whichever is less. Any rate may be charged when identified in a contract in writing on a loan greater than $15,000. Ky. Rev. Stat. Ann. § 360.010

Louisiana The general usury rate is 12%. La. Rev. Stat. Ann. § 9:3500

Maine The legal interest rate is 6% (no usury limit mentioned in statutes). Maine Rev. Stat., titl. 9-B, § 432

Maryland The legal interest rate is 6%, a maximum of 8% if a written contract is established. Md. Code Ann., Com. Law § 12-102 – 103

Massachusetts The legal interest rate is 6% (unless a written contract exists); even if part of a contract, an interest rate over 20% is criminally usurious. Mass. Gen. Law Ch. 107, § 3 and Ch. 271, § 49

Michigan 7% maximum if a written contract is established. Otherwise, the legal rate is 5%. Mich. Comp. Laws § 438.31

Minnesota The legal rate of interest is 6%. For written contracts, the usury limit is 8%, unless for an amount over $100,000, in which case there is no limit. Minn. Stat. § 334.01

Mississippi The legal rate of interest is 8%. Parties may contract for a rate of up to 10% or 5% above the Federal Reserve discount rate, whichever is greater. Miss. Code Ann. § 75-17-1

Missouri The maximum interest rate is 10%, unless the market rate is greater at the time. Mo. Rev. Stat. § 408.030

Montana 15% or 6% above the rate published by the Federal Reserve System, whichever is greater. Mont. Code Ann. § 31-1-107 NebraskaThe maximum interest rate is 16%. Neb. Rev. Stat. § 45-101.03

Nevada Parties may contract for a rate up to the lesser of 36% or the maximum rate permitted under the federal Military Lending Act. Nev. Rev. Stat. § 99.050

New Hampshire There is no legal limit on interest rates. It is unclear whether an exorbitant rate could be considered “unfair” under the New Hampshire Consumer Protection Act and hence unlawful. N.H. Rev. Stat. Ann. § 336:1, § 358-A:2

New Jersey 6% without a written contract, 16% maximum if a written contract is established. N.J. Stat. Ann. § 31:1-1

New Mexico 15% maximum in the absence of a written contract. N.M. Stat. Ann. § 56-8-3

New York The legal rate of interest is 6%, the general usury limit is 11.25% N.Y. Gen. Oblig. § 5-501 and N.Y. Banking § 14-A

North Carolina For loans less for less than $25,000, the maximum is the amount announced on the 15th of each month by the North Carolina Commissioner of Banks. For loans greater than $25,000, the parties may agree in writing to any amount. N.C. Gen. Stat. § 24-1.1

North Dakota For written contracts for loans less than $35,000, the maximum rate is 5.5% above the current maturity rate of Treasury Bills for the six months preceding the issuing of the loan, or 7%, whichever is greater. N.D. Cent. Code § 47-14-09

Ohio The maximum interest for written contracts for loans of amounts less than $100,000 is 8%. Ohio Rev. Code Ann. § 1343.01

Oklahoma The parties may agree in a written contract to any rate so long as it does not violate other applicable laws. Okla. Stat. tit. 15, §266

Oregon The legal interest rate is 9%, but the parties may agree to different rates in a written agreement. Business and agricultural loans have a maximum of 12 percent or five percent greater than the 90-day discount rate of commercial paper. Or. Rev. Stat. § 82.010

Pennsylvania For loans less than $50,000, the maximum rate is 6%. 41 Pa. Cons. Stat. Ann. § 201

Rhode Island The maximum interest rate is the greater of 21%, or the domestic prime rate as published in the Wall Street Journal plus 9%. R.I. Gen. Law § 6-26-2

South Carolina Unsupervised lenders may not charge a rate above 12%. No lender may charge a rate above 18%. S.C. Code Ann. § 37-3-201

South Dakota No limit if a written agreement is established, 12% if no agreement exists. S.D. Codified Laws § 54-3-4 and § 54-3-16(3)

Tennessee The maximum rate is 10% unless otherwise expressed in a written contract. Tenn. Code Ann. § 47-14-103

Texas The parties may agree in writing to a maximum rate up to the weekly ceiling as published in the Texas Credit Letter. If no agreement exists, then the maximum is 10%. Tex. Fin. Code Ann. § 302.001(b), §303.002

Utah The maximum rate of interest is 10% unless the parties agree to a different rate in a written contract. Utah Code Ann. § 15-1-1

Vermont The rate of interest is 12% except in certain circumstances as provided in subsection (b) of § 41a.Vt. Stat. Ann. tit. 9, § 41a

Virginia The legal rate of interest is 6%. With a contract in place, the maximum interest rate is 12%. Va. Code Ann. § 6.2-301 and § 6.2-303

Washington The maximum rate of interest is 12% or 4% points above the average bill rate for 26-week treasury bills in the month before the loan was made. Wash. Rev. Code § 19.52.020

Washington D.C. The maximum rate of interest is 24% for written contracts and 6% for verbal contracts. D.C. Code, Title 29, Chapter 33

West Virginia The legal interest rate is 6% but parties may agree to a maximum of 8% in a written agreement. W. Va. Code § 47-6-5

Wisconsin The legal rate of interest is 5%. Parties may agree to a different rate in a written agreement, subject to limitations that depend on the identity of the lender. Wis. Stat. § 138.04

Wyoming The rate of interest is 7% if no agreement is established in a written contract. Otherwise, parties may agree to a higher rate.Wyo. Stat. Ann. § 40-14-106

Return from Personal Promissory Note Template to Home page.

DISCLAIMER: The law will vary depending on your state and the specifics of your case. The information provided by USAttorneyLegalServices.com is intended for educational purposes only. All the content on this website should NOT be considered professional legal advice or a substitute for professional legal advice. For such services, we recommend getting a free initial consultation by a licensed Attorney in your State.