FREE SIMPLE PROMISSORY NOTE

Printable IOU Blank Letter

A simple promissory note is a brief document written in simpler terms between two people over a loan or transaction.

Thinking about bailing out family or friends?

With the economy the way it is right now many of us have been asked by family members and friends for loans. When the "I'll pay you back on Friday" does not happen, having a signed loan contract can improve the chances of getting your money back.

A simple promissory note is a written document that outlines a promise from one party (the "promisor" or "borrower") to pay a specific sum of money to another party (the "promisee" or "lender") at a predetermined date or upon demand. It serves as a legally binding agreement and establishes the terms of a loan or debt between individuals or entities. Unlike more complex financial instruments, a simple promissory note does not involve collateral or extensive details, making it relatively easy to create.

A promissory letter or IOU is a written promise made by the borrower to the creditor to pay a certain amount of money on a specific date.

Here’s how to create a simple promissory note:

Identify the Parties: Clearly state the full names and addresses of both the borrower and the lender.

Loan Amount: Specify the amount of money being borrowed by the borrower. Write both the amount in words and numerals to avoid any confusion.

Interest (if applicable): If the loan includes an interest rate, clearly state the rate and how it will be calculated. For simple promissory notes without interest, this section can be omitted.

Repayment Terms: Outline the terms of repayment, including the due date or dates and the method of payment (e.g., lump-sum payment or installments).

Default and Consequences: Explain the consequences of defaulting on the loan, such as late fees, penalties, or potential legal action.

Maturity Date: If the loan has a specific repayment date, mention it in the document. If it is payable upon demand, state that the borrower will repay the loan when the lender requests it.

Signatures: Both the borrower and the lender must sign and date the promissory note to make it legally valid.

Witness (optional): While not always required, having a witness sign the promissory note can add an extra layer of authenticity.

Governing Law: Indicate the state or country laws that will govern the promissory note.

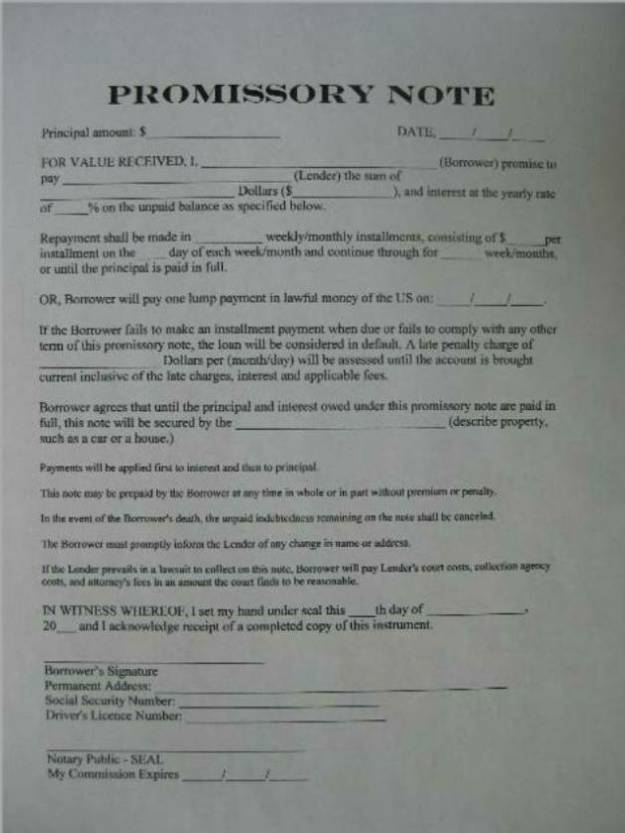

Below you'll find a Simple Promissory Note sample. It's also a Promise to Pay Letter or Printable IOU. Just copy and paste to your word processor, making the changes and corrections necessary.

IMPORTANT: Consult a licensed attorney near you for a more detailed document tailored for your specific needs. It'll have a better chance of holding up in court in case of legal dispute.

PROMISSORY NOTE

PRINCIPAL AMOUNT: $ ____________________ DUE DATE: ___________,_____ of 20___.

On this _______ day of _______________ in the year two thousand and ___________, I, __________________________________ (Borrower’s name) promise to pay to the order of ____________________________________ (Payee’s name) resident of ______________ ________________________________________ City: _____________________________, State: _____ Zip :________

OR its HOLDER to the amount of: ______________________________________ DOLLARS.

Interest at the yearly rate of _____% will be added to the unpaid balance. A late charge of $_____________ Dollars will be added to the principal if payment is not made within _____ days of the due date.

Payable on: __________________ (city) - _____________ (state)

SIMPLE PROMISSORY NOTE SAMPLE

(Your Name)

(Your Address)

(City, State, Zip Code)

(Date)

PROMISSORY NOTE

FOR VALUE RECEIVED, I, _____________________ (Borrower's Full Name), residing at _________________________ (Borrower's Address), hereby promise to pay to _________________________(Lender's Full Name), residing at _________________ (Lender's Address), the sum of __________________________ (Loan Amount in words (e.g., "Five Hundred Dollars") ($ ____________ (Loan Amount in numbers: 500.00).

Repayment Terms: The Borrower shall repay the loan in ________ (number of installments) equal installments, with the first payment due on ___/___/_____(First Payment Due Date) and subsequent payments due on the same day of each month until the loan is fully repaid.

Interest: _________________ (State if there's an interest rate or mention "No interest" if interest-free)

Maturity Date: ___/___/____(Specific date or "Upon demand" if payable on demand)

Default: In case of default, the Borrower shall be liable for _________________ (mention consequences, e.g., late fees, penalties, etc.).

Governing Law: This Promissory Note shall be governed by and construed in accordance with the laws of ______________________ (State/Country).

IN WITNESS WHEREOF, the Borrower has executed this Promissory Note as of the date first above written.

__________________________

(Borrower's Signature)

__________________________

(Lender's Signature)

Sample Promissory Note - Long Version

Usury Laws by State

Common terms of a simple promissory note, IOU, promise to pay, loan agreement:

- Borrower, promisor, obligor - person who receives the money and must pay back the loan.

- Lender, promisee, obligee - person who lends the money, receives the payments for the loan.

- Principal, consideration - amount that is lent by the lender to the borrower, the amount that must be paid, the value of the note.

- Secured Promissory Note - offers collateral to the lender such as, a house, car, personal property.

- Unsecured Promissory Note - offers NO collateral to the lender.

- Collateral - property offered in case payment cannot be made.

- Due date, maturity date - The day borrower must make payment.

- Security agreement - describes in detail the collateral offered (if it is a car, the make, model, VIN, year, mileage, etc.)

- Acceleration clause - stipulates that the note’s remaining total becomes due if a payment is missed.

- Usury laws - dictates the highest amount of interest that may be charged to the borrower, among other regulations.

Return from simple promissory note to Home page.

DISCLAIMER: The law will vary depending on your state, jurisdiction and the specifics of your case. The information provided by lawhood.com is intended for educational purposes only. The content on this site should NOT be considered professional legal advice or a substitute for professional legal advice. For such services, we recommend getting a free initial consultation by a licensed Attorney in your state.